Wrapping your mind around CAC can feel like a steep climb, and frankly, many founders only manage to calculate customer acquisition cost after they’ve surrendered some startup equity just to learn the basics of go-to-market strategies.

But here’s the good news – at Data-Mania, we’re all about empowering startup founders. We believe in sharing, not sparing, the wealth of go-to-market expertise we’ve gathered over the years. And the best part? We’re giving it all away – no equity required!

In this blog post, we’re going to unwrap the mystery of CAC calculation, ensuring you’re well-equipped with a thorough understanding of this essential business metric.

We will explore various aspects of calculating CAC such as:

- determining which expenses to include in your calculations,

- whether or not to factor in overhead costs,

- allocating shared costs effectively, and

- accounting for one-time expenditures.

We’ll also shed light on to monitor CAC performance and advise you on how frequently you should give your figures a check-up.

Once you’ve got a grip on these concepts, you’ll unlock a treasure trove of insights into your tech startup’s performance. This knowledge is your secret weapon to make savvy decisions that not only improve your customer’s experience but also boost your bottom line. It’s all about turning data into decisions that deliver!

- What is Customer Acquisition Cost (CAC)?

- How to Calculate Customer Acquisition Cost

- Tools To Help You Calculate Customer Acquisition Cost

- What Expenses Should I Include in My Customer Acquisition Cost Calculation?

- Why Do I Need to Include Overhead Costs in My CAC Calculation?

- Why Do I Need to Include One-Time Costs in My CAC Calculation?

- How Should I Allocate Shared Costs When Calculating CAC?

- How Do I Account for Different Marketing Channels When Calculating CAC?

- How Often Should I Calculate My CAC?

- Reviewing The Performance of Your Customer Acquisition Cost

- FAQs in Relation to Calculate Customer Acquisition Cost

- Final Thoughts

What is Customer Acquisition Cost (CAC)?

Think of customer acquisition cost (CAC) as the price tag for bringing in new customers. This crucial figure is the key to understanding how much your tech startup has to shell out not only to reel in fresh customers but also to keep them hooked.

CAC serves as your compass, guiding you to assess the return on investment (ROI) from your marketing campaigns and sales drives. It acts as a spotlight, highlighting the areas where your strategies might need a little tune-up.

Case in point, let’s talk about my high-flying student, Kam Lee…

Kam is a true maverick who managed to pre-sell his SaaS, all the while pulling in an impressive six-figure income from his services.

How did he manage to keep his profit margins soaring to a whopping 67%? The answer – a solid grip on his customer acquisition costs. This golden nugget of knowledge allowed Kam to refine his spending, captivate the right audience, and send his profits stratospheric.

Bottom line – understanding your CAC is like unlocking a cheat code for smart customer acquisition.

How to Calculate Customer Acquisition Cost

Here’s a simple step-by-step guide to help you calculate customer acquisition cost:

Step 1: Tally All Direct Costs Related to Customer Acquisition

The first step to calculate customer acquisition cost is to sum up all the direct costs associated with acquiring new customers. These costs could include advertising and marketing expenses, sales commissions, lead generation costs, and any promotional costs.

Example: If you spent $1000 on Google Ads, $500 on a LinkedIn ad campaign, and paid $200 in sales commissions, your total direct costs would be $1700.

Step 2: Include Overhead Costs Related to Customer Acquisition

Overhead costs that contribute directly or indirectly to customer acquisition should also be included. This could be subscription fees for marketing tools, costs related to contractors or agency fees, or even a portion of your office rent.

Example: If you have a $50/month subscription to an email marketing tool, and you pay $100/month for a customer relationship management (CRM) system, you would add these to your total cost.

Formula: Total Direct Costs + Overhead Costs = Total Costs

Example: $1700 (from step 1) + $150 (from step 2) = $1850 Total Costs

Step 3: Allocate Shared Costs Among Different Sales Channels

If you use multiple channels for customer acquisition, you should allocate shared costs among these channels based on their contribution to sales. For instance, if an email campaign and a PPC campaign both contribute to a sale, you would split the cost of those campaigns equally for that sale’s CAC calculation.

Example: If your total advertising cost is $1500 and your email campaign contributed to 60% of the sales while the PPC campaign contributed to 40% of sales, then allocate $900 to the email campaign and $600 to the PPC campaign.

Step 4: Account for One-Time Costs

One-time costs such as setup fees or signup bonuses should also be included in your CAC calculation. While these don’t typically figure into monthly calculations, they still affect the overall ROI from customer acquisition over time.

Example: If you offer a one-time signup bonus of $100 for a new customer, include this in your CAC calculation.

Step 5: Divide the Total Costs by the Number of Customers Acquired

Finally, to calculate the CAC, divide the total costs by the number of customers acquired in the period the money was spent.

Formula: Total Costs / Number of Customers Acquired = CAC

Example: If the total costs are $2000 and you acquired 10 customers, your CAC would be $200.

Step 6: Regularly Recalculate Your CAC

Revisiting your CAC regularly is critical for evaluating the effectiveness of your marketing and sales efforts. Depending on the pace of your startup, it could be monthly, quarterly, or biannually.

Regular recalculation can help you identify trends, and opportunities for optimization, and give you a sense of whether your spending is in line with your long-term revenue and profit goals.

Still a bit overwhelmed? Check out this video from Eric Andrews ⬇️

Tools To Help You Calculate Customer Acquisition Cost

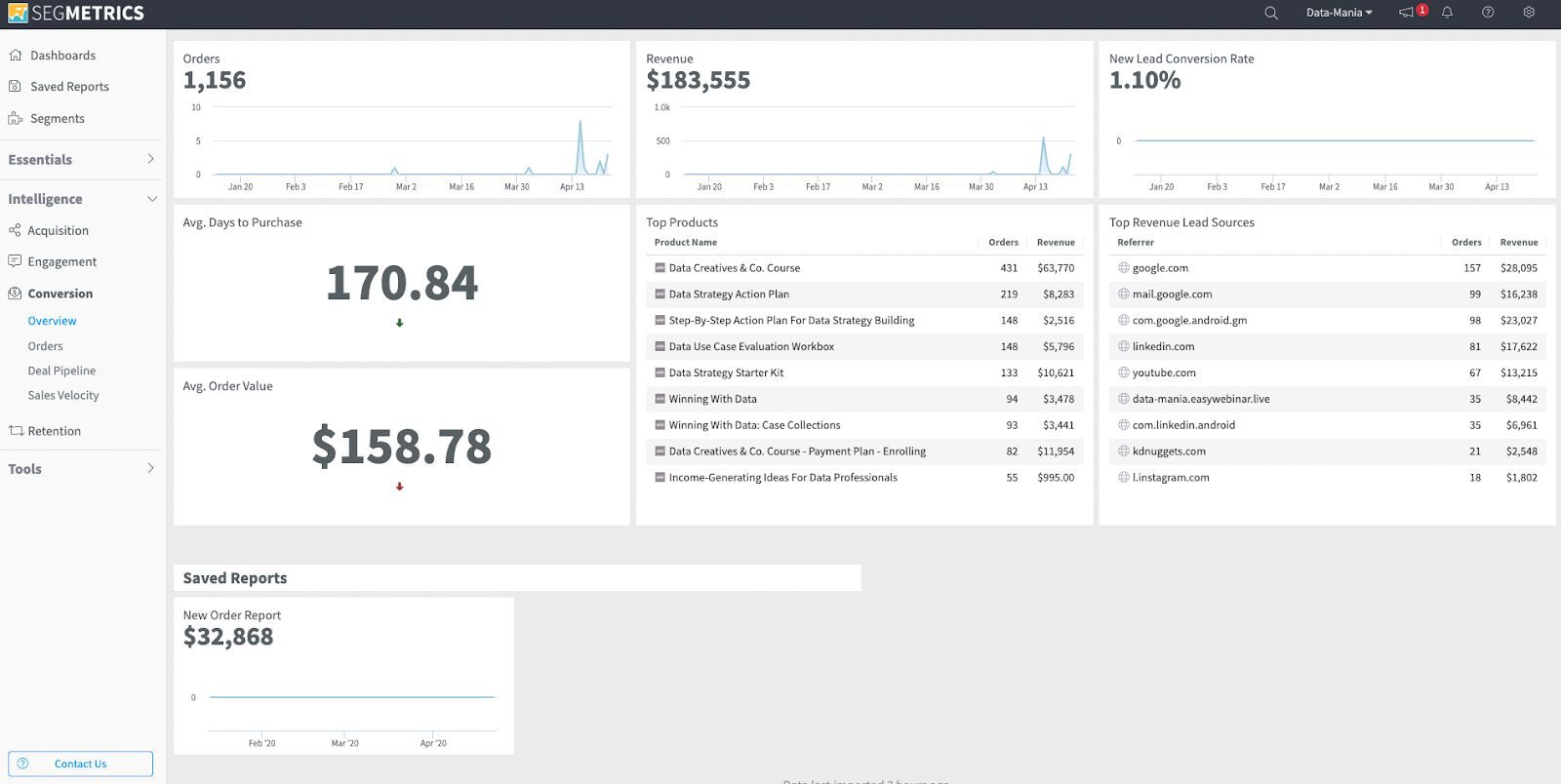

Data is a lifesaver in the fast-paced world of startups. That’s why tools like Segmetrics can be game-changers when it comes to managing your marketing efforts and understanding your cost of customer acquisition.

I can speak from experience.

Prior to using Segmetrics (that is an affiliate link so I may receive a small comission if you purchase a plan after clicking that link), my marketing strategy felt a bit like a guessing game. I had a vague sense of where my customers were coming from, but no real clarity on the performance of different channels. It felt like I was running on a treadmill, expending energy and resources but not making the progress I wanted.

Everything shifted when I plugged my marketing channels into Segmetrics. Suddenly, I had a clear, data-driven view of my customer acquisition process. Now, even though I’m currently focused on organic marketing channels – which means I’m not calculating CAC against ad spend – Segmetrics is still an invaluable asset.

Through this tool, I am able to track each organic channel’s lead generation and sales in real-time. I’m able to cross-reference the performance of these channels against the time and money I invest in them.

The outcome?

Optimized growth, reduced overall CAC, and the confidence that my resources are being invested in the right areas.

Understanding your CAC isn’t just a good practice – it’s essential for driving growth and profitability. By calculating and optimizing your CAC, you can ensure you’re investing your resources wisely, just as I did.

For more on how I use Segmetrics to measure and quantify the ROI of my omnichannel marketing efforts, visit this blog post here or watch it below:

What Expenses Should I Include in My Customer Acquisition Cost Calculation?

When you go to calculate customer acquisition cost (CAC), remember that every cost matters – both the direct and the indirect.

Direct costs are your straightforward expenses – they’re tied directly to winning over new customers, like your marketing budget or sales commissions.

On the other hand, indirect costs are a bit more elusive but just as essential. They’re the overhead expenses quietly supporting your customer acquisition efforts, from administrative payroll to tech infrastructure investments.

Let’s take a deeper dive…

Marketing Spend:

The most obvious expense when calculating customer acquisition cost is the money spent on marketing activities designed to acquire new customers. This can span a wide spectrum of techniques, from online ads and SEO tactics to social media pushes and email campaigns.

The real trick is not just to spend, but to evaluate – scrutinize each marketing channel to see where your dollars bring in the best bang for the buck. It’s all about nudging your ROI into the sweet spot.

Sales Commissions:

Your CAC calculation should also include sales commissions as they represent costs associated with acquiring new customers. Depending on your business model, your commission expenses could include:

- Commission for your sales team who successfully seal the deals.

- Kickbacks from your referral programs, perhaps aimed at your loyal existing customers who spread the word and bring in fresh leads or new customers to your service or product.

- Affiliate partnerships where you pay a commission to bloggers, influencers, or other businesses for promoting your products or services and driving new customers your way.

- Incentives you offer to freelance sales agents who sell your product on a commission basis.

Overhead Costs:

Your CAC calculation should also include sales commissions as they represent costs associated with acquiring new customers. Depending on your business model, your commission expenses could include:

- Commission for your sales team who successfully seal the deals.

- Kickbacks from your referral programs, perhaps aimed at your loyal existing customers who spread the word and bring in fresh leads or new customers to your service or product.

- Affiliate partnerships where you pay a commission to bloggers, influencers, or other businesses for promoting your products or services and driving new customers your way.

- Incentives you offer to freelance sales agents who sell your product on a commission basis.

One-Time Costs:

When you calculate customer acquisition costs, don’t overlook those one-time costs, the ones that pop up occasionally yet make a significant dent in your budget.

Maybe it’s those travel expenses for the trade shows you attend, legal fees during your negotiation over a hefty contract, or even special promotions tied to exclusive partnerships.

Sure, these costs won’t show up on your monthly radar, but overlooking them could lead to distorted figures over the long haul.

Why Do I Need to Include Overhead Costs in My CAC Calculation?

As tech startup founders and leaders, the question often pops up – should you or should you not factor in overhead costs when calculating customer acquisition costs?

I personally lean towards including them, but it’s important to note there isn’t a definitive answer. Both paths come with their distinct advantages and challenges.

Advantages:

You get a comprehensive cost view. When overhead costs are included in your CAC calculation, you get a more complete picture of the true expenditure linked with bringing in a new customer.

Challenges:

Allocating overhead costs can be complex. Distributing shared expenses across different marketing campaigns can get tricky and complicated. The waters get particularly muddied when some of these costs don’t directly tie into attracting new customers or boosting revenue.

Let’s say your tech startup pays out $5K every month for office rent. This cost doesn’t tie directly to any specific campaign or channel, yet it takes a significant bite out of your overall profitability.

If your CAC calculation only includes direct advertising spend, this substantial cost won’t factor into the equation. However, if you decide to bring overhead costs into the mix, the results could be skewed depending on the budget allotted to each channel during that period.

Ultimately, gaining an in-depth understanding of your total spending to acquire customers is key. As you move forward, it’s crucial to comprehend how shared costs should be allocated to calculate your CAC accurately. (We’ll cover that later)

Why Do I Need to Include One-Time Costs in My CAC Calculation?

When calculating customer acquisition costs, it’s important to remember one-time costs. These are expenses that occur only once, such as setup fees or permit charges, and are not recurring.

By including these costs in your CAC calculation, you can better understand the total costs involved in gaining new customers.

However, there are situations where including these costs may not be necessary or beneficial:

- If your growth strategy involves acquiring a large number of customers, each associated with similar one-time costs, their inclusion could artificially inflate your CAC, misrepresenting your regular acquisition costs.

- Non-recurring, unique costs: There could be unique costs tied to a specific situation or time period that are not representative of your ongoing customer acquisition process.

- Infrequent, large-scale promotions: One-time costs related to large promotions or marketing blitzes that significantly deviate from your regular spending can distort your standard CAC.

- Early-stage startup costs: These costs, while important to your initial operations, might not directly contribute to the acquisition of each new customer.

- Anticipated efficiency improvements: If you foresee significant reductions in certain one-time costs due to operational improvements, it may be best to exclude these from your ongoing CAC calculations.

Also, remember that some costs might seem like one-time expenses but could turn into regular costs. For example, you might make a large initial payment for a service and then have to pay smaller fees each year to keep using it. In this case, what seemed like a one-time cost has become an ongoing expense.

So, it’s important to consider all the initial costs when you calculate your CAC. This will give you a better idea of your total marketing spend. And remember, you should regularly update your CAC calculation to keep it accurate and helpful.

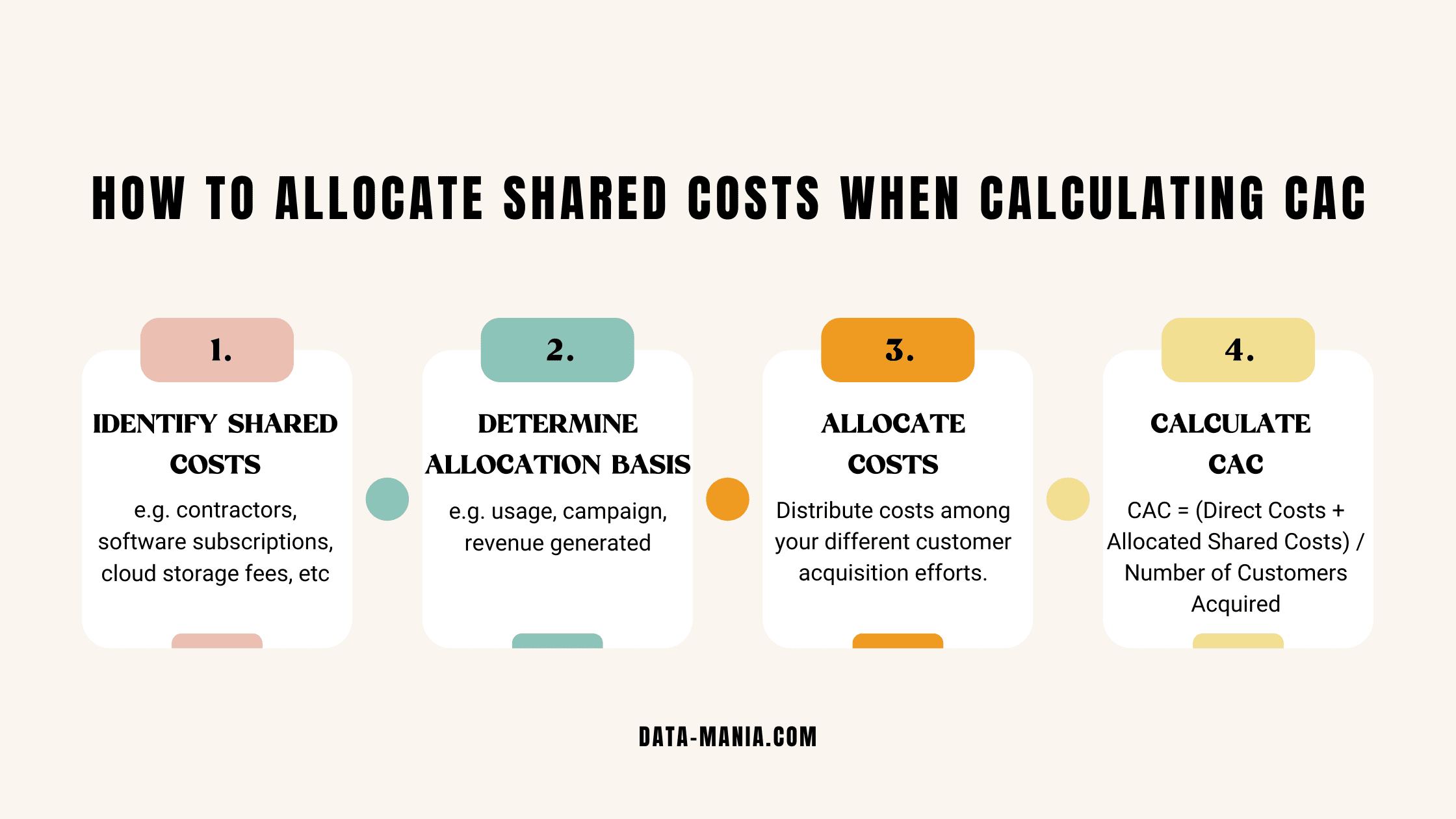

How Should I Allocate Shared Costs When You're Working To Calculate Customer Acquisition Cost?

1. Identify shared costs:

Your first step is to identify all the shared costs in your organization. In a tech startup, these could include expenses such as contractors, software subscriptions, cloud storage fees, co-working space rent, or other operational costs that are not directly linked to a particular department or campaign but are essential for your operation.

Example: Let’s say you have a $2,000 per month subscription to a suite of software tools that are used by your sales, marketing, and product teams.

2. Determine allocation basis:

Next, decide on the method you’ll use to distribute these costs. This can be based on the usage of each department or campaign, or the revenue they generate.

Example: You decide to allocate costs based on usage. After analyzing the usage logs, you determine that the sales and marketing teams use these tools 70% of the time for customer acquisition efforts.

3. Allocate costs:

Now, you can distribute these costs among your different customer acquisition efforts.

Example: Using the usage logs as the basis for allocation, you would allocate 70% of $2,000, which is $1,400, to sales and marketing.

4. Calculate CAC:

Once you’ve allocated these costs, include them in your CAC calculation. Add these allocated costs to your direct costs like ad spend.

Here’s a simple formula for calculating CAC with shared costs:

CAC = (Direct Costs + Allocated Shared Costs) / Number of Customers Acquired

Example: If you spent $600 on advertising (direct costs), and you’ve allocated $1,400 of shared costs to customer acquisition, and you acquired 50 customers:

CAC = ($600 + $1,400) / 50 = $40 per customer

Remember, allocating shared costs is more of an art than an exact science. The key is to be consistent with your method and adjust as necessary for accurate trend analysis over time.

Regular reviews of your allocation basis will help ensure that your CAC calculations remain accurate and reflective of your current business operations.

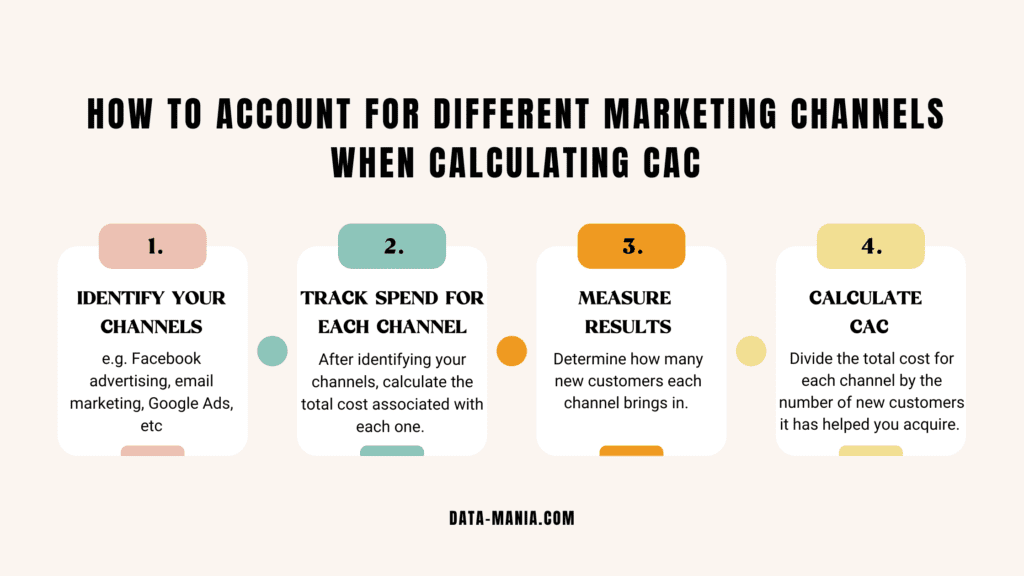

How Do I Account for Different Marketing Channels When You Calculate Customer Acquisition Cost?

Different channels have different costs, and this can affect your CAC calculation. Each channel must be accounted for individually in order to calculate your CAC accurately.

Here’s how to do it:

1. Identify your channels:

Start by pinpointing all the marketing channels you’re using. Let’s say, for instance, you use Facebook advertising, email marketing, and Google Ads as your primary channels.

2. Track spend for each channel:

After identifying your channels, calculate the total cost associated with each one.

For example:

- Facebook advertising: $3000

- Email marketing: $2000 (including costs of email automation software, content creation, and time spent on campaign management)

- Google Ads: $3500

3. Measure results:

The third step is to determine how many new customers each channel brings in.

For instance, let’s assume you have acquired:

- Facebook advertising: 45 new customers

- Email marketing: 25 new customers

- Google Ads: 35 new customers

4. Calculate CAC for each channel:

Now, divide the total cost for each channel by the number of new customers it has helped you acquire.

That would look like this:

- CAC (Facebook advertising) = Total cost / Number of customers = $3000 / 45 = $66.67 per customer

- CAC (Email marketing) = Total cost / Number of customers = $2000 / 25 = $80 per customer

- CAC (Google Ads) = Total cost / Number of customers = $3500 / 35 = $100 per customer

How Often Should I Calculate My CAC?

There isn’t a one-size-fits-all answer because the frequency depends on your business size, sales process complexity, and growth rate.

- Startups: If you’re just starting out and still working on establishing a steady customer base, it’s crucial to calculate your CAC as frequently as possible. This constant measurement provides a clear picture of your marketing efforts’ ROI and helps identify optimization opportunities to reduce costs and increase profits.

- Rapid growth phase: For businesses experiencing rapid growth, it’s advisable to calculate CAC at least quarterly. Regular tracking ensures your marketing efforts remain profitable over time. Plus, it allows you to spot and address potential issues early, preventing costly mistakes in the long run.

- Mature businesses: Once your company has matured, continue tracking your CAC monthly or quarterly, depending on the complexity of your operations. This practice helps you react quickly to unexpected occurrences like increased competition or sudden market changes.

- Major changes: Whenever your company undergoes significant changes, such as launching a new product or shifting target markets, you should recalculate your CAC promptly. This immediate adjustment prevents these changes from negatively affecting your profitability down the line.

Overall, CAC is not a static figure; it changes with time. Regular monitoring and adjustment of your CAC can aid in understanding the impact of various marketing channels, enabling better decision-making and maximizing ROI.

Reviewing The Performance of Your Customer Acquisition Cost

Understanding and monitoring your customer acquisition cost is a crucial step, but it doesn’t end there. Periodically reviewing the performance of your CAC can give you invaluable insights into your marketing efforts and their effectiveness.

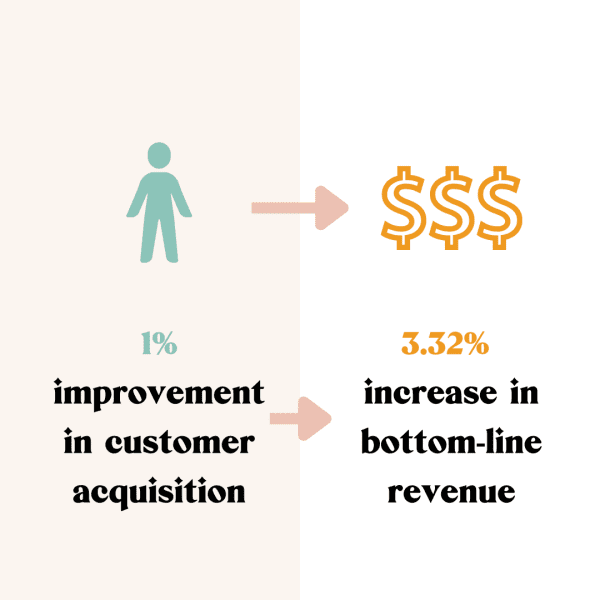

According to Price Inteligently, even a 1% improvement in customer acquisition can result in a 3.32% increase in bottom-line revenue.

The above example illustrates how refined customer acquisition strategies (no matter how small) can make a significant difference to your profitability. A regular review and optimization of your CAC should therefore be an essential part of your business growth plan.

Step 1: Benchmarking Your CAC

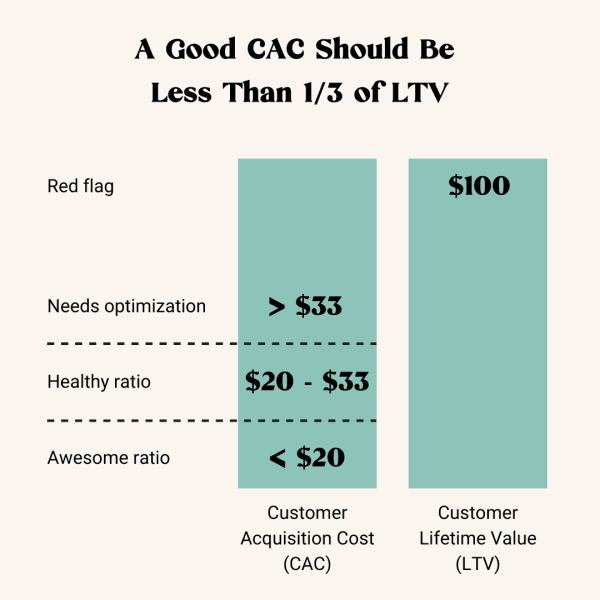

Start by establishing a benchmark or a baseline for your CAC. This will vary depending on your industry, business model, and customer lifetime value (LTV). Your goal should be to maintain a CAC that is significantly lower than your LTV.

Suppose you’re a SaaS startup, and industry standards suggest that your customer lifetime value (LTV) to CAC ratio should be about 3:1. This means that for every dollar spent on customer acquisition, you should be getting three dollars back over the customer’s lifetime.

Step 2: Monitor CAC Over Time

Once your benchmark is set, it’s crucial to monitor how your CAC evolves over time. If your CAC begins to increase significantly, it could indicate that your marketing efforts are becoming less efficient.

Conversely, a declining CAC might signify improving efficiency, or it could potentially mean that you’re not investing enough in customer acquisition to support growth.

Step 3: Assess Channel Performance

Different marketing channels may have different CACs. For instance, customers from a paid search campaign might have a higher CAC than those acquired through organic social media. By breaking down your CAC by channel, you can assess which methods are the most cost-effective for acquiring new customers.

Step 4: Analyze the Impact of Changes

Whenever there are significant changes in your marketing strategy, product offerings, or target market, closely monitor how these changes impact your CAC. This can help you quickly identify any shifts that are causing your CAC to increase and adjust your strategies accordingly.

Let’s say you decide to launch a major upgrade to your service. You calculate your CAC before and after the product upgrade. Increasing CAC after the launch may indicate that the messaging around the product upgrade isn’t effectively conveying its value, leading to higher acquisition costs.

Step 5: Regular Reporting

Regular reporting on your CAC and its performance should be a key part of your overall business strategy. This practice not only keeps you and your team informed about the cost-effectiveness of your marketing efforts but also helps in decision-making and strategy planning.

FAQs in Relation to Calculate Customer Acquisition Cost

What is a good CAC?

There’s no one-size-fits-all answer here. However, a good rule of thumb for tech startups is to aim for your CAC to be about 1-3x less than your customer’s lifetime value (LTV). But remember, this ratio can vary depending on your industry and current market conditions.

So, it’s crucial to evaluate your business scenario independently to set a CAC goal that aligns with your unique startup environment. After all, mastering how to calculate customer acquisition cost effectively is all about understanding your specific situation.

How do I know if my CAC is too high?

To determine if your CAC is too high, you need to compare it to the lifetime value of your customers (LTV). If your CAC exceeds your LTV, then your CAC is likely too high. It means you’re spending more to acquire customers than you’re making from them over their lifetime. This is a sign that you need to either find ways to reduce your CAC or increase your LTV.

How can I reduce my CAC?

A startup can reduce its CAC by improving its marketing efficiency, enhancing its sales process, optimizing its conversion rates, and nurturing existing customer relationships to encourage referrals.

Why does my CAC fluctuate over time?

CAC can fluctuate over time due to several factors. These can include changes in advertising costs, variations in your conversion rates, shifts in your marketing strategies, changes in the competitive landscape, and seasonal trends. It’s important to track these fluctuations to understand their causes and make necessary adjustments to your acquisition strategies.

Can high CAC be justified for certain startups?

Yes, a high CAC can sometimes be justified, especially for startups where customers have a high lifetime value (LTV). For example, in industries like SaaS where customers pay a recurring fee and tend to stay for long periods, a high initial CAC can be offset by the revenue generated over the customer’s lifetime. However, startups must be careful to ensure that the LTV significantly exceeds the CAC for sustainability.

How do upsells and cross-sells affect the CAC

When you upsell or cross-sell, you are effectively increasing the value of each customer without incurring additional customer acquisition costs. This means that you can spread your CAC over a higher revenue, which in turn decreases the CAC when expressed as a ratio of cost to revenue per customer.

Let’s say you spent $1000 on marketing to acquire 10 customers, making your CAC $100. But, if you successfully upsell or cross-sell to those customers, increasing the total revenue they bring in from $1000 to $2000, your CAC is now effectively $50 when expressed as a ratio of cost to revenue per customer.

How do free trials or freemium models affect my CAC?

Free trials or freemium models can increase your CAC as you may spend resources acquiring users who never convert to paying customers. However, they can also potentially lower your CAC if they lead to high conversion rates.

Free trials and freemium models can effectively lower the barrier to entry, enabling you to draw in more users. If a significant number of these users convert to paid customers, your CAC may decrease as the costs of acquisition are spread over a larger number of customers.

What is the difference between CAC and CPA (Cost Per Acquisition)?

While CAC refers to the cost of acquiring a new customer, CPA refers to the cost of acquiring a new lead, conversion, user action, or sale, depending on the company’s definition. CPA is often used in online advertising and refers to a narrower, more immediate outcome compared to CAC.

Final Thoughts

Calculating customer acquisition cost is a vital exercise to gauge the efficacy of your marketing and sales strategies. By tracking, analyzing, and calculating, you’ll gain insights that allow you to allocate resources wisely for the highest ROI.

Remember, CAC calculation isn’t just about tallying up expenses; it’s about examining every cost linked to the journey of winning a new customer and discerning the effectiveness of different marketing channels. This level of detail helps you spot potential areas of improvement and drive more value from your investment.

Regularly revisiting your CAC not only keeps you informed about current trends but also empowers you to make future investment decisions that propel growth and optimize profits.

Ready to skyrocket your tech startup growth?