If not, don’t worry – I’ve got you covered.

The information you need to know about startup metrics (like these) shouldn’t require you to give up equity. This information should be made freely available to all founders – and that’s why I’m writing this blog.

In this post, we’re going to de-mystify these crucial metrics, shine a light on their significance, and I’ll also guide you through the step-by-step process of calculating them.

By the end of this article, you’ll have a comprehensive understanding of ARR vs MRR. You’ll come away feeling empowered and relieved, knowing you’ve dodged the common errors made by those who misjudged these metrics.

So, are you ready to elevate your understanding of ARR vs MRR calculations without the costly price tag of your startup’s equity? Let’s unravel this essential topic together because, in the world of tech startups, knowledge is your greatest asset!

Follow me on:

Table of Contents:

- MRR vs ARR: What’s The Difference?

- MRR and ARR: Revenue, Not Profit

- When To Use MRR

- When To Avoid Using MRR

- When to Use ARR

- When to Avoid Using ARR

- When to Avoid Using ARR

- MRR vs ARR: How to Calculate Them

- How to Calculate MRR

- How to Calculate ARR

- Common Pitfalls When Calculating MRR and ARR

- FAQs in Relation to MRR vs ARR

- What is the main difference between ARR vs MRR?

- MRR vs ARR: which one should I use?

- Why are ARR and MRR so important to the cloud business?

- How does customer churn affect MRR?

- What is the difference between contracted annual recurring revenue and annual recurring revenue?

- Can Annual Recurring Revenue be higher than revenue?

- What other metrics should I consider in addition to MRR and ARR?

- Final Thoughts

If this topic is right up your alley, then be sure to sign up for the Data-Mania Substack newsletter.

That’s where we share cutting-edge insights, trends, and impartial perspectives that help data & technology service providers, SaaS founders, and consultants to harness the potential of applied AI, build strategic data-intensive solutions, and catalyze rapid business growth.

↓↓↓

MRR vs ARR: What’s The Difference?

MRR and ARR, while similar, serve very unique purposes in a startup’s financial toolkit.

Monthly recurring revenue (MRR) is your financial pulse check, providing a snapshot of the recurring revenue generated from subscriptions each month. It’s a dynamic and responsive metric, able to reflect shifts in your customer base and revenue patterns on a monthly basis.

On the other hand, annual recurring revenue (ARR) broadens the perspective to a yearly view. It offers an annualized estimate of recurring revenue, providing a stable and long-term picture of your financial health. It’s ideal for assessing year-on-year growth and making strategic decisions that require a more long-term view.

In essence, MRR provides granularity to navigate short-term, monthly trends, while ARR offers a comprehensive annual perspective for long-term planning. Understanding when to use each is key.

Editor’s Note: MRR and ARR are two of the most essential metrics for tech startups to monitor, with MRR tracking short-term performance while ARR gives a longer-term view on growth. To accurately measure success over time, it is necessary to assess other indicators such as AOV and LTV in addition to using these two recurring revenue figures.

MRR and ARR: Revenue, Not Profit

I often get asked… “Are MRR and ARR about revenue or profit?”

So, before we get into the nitty-gritty, let’s set the record straight – MRR and ARR are all about revenue, not profit.

Here’s why this distinction matters:

- Revenue-Focused: When we talk about MRR or ARR, we’re focusing on the recurring revenue you’re earning from your customers. It’s like the fuel that keeps your business engine running month after month, or year after year.

- Doesn’t include costs: MRR and ARR don’t take into account your operational costs. So while they give you a solid snapshot of your revenue performance, they don’t tell you anything about your profitability.

- Revenue-Focused: When we talk about MRR or ARR, we’re focusing on the recurring revenue you’re earning from your customers. It’s like the fuel that keeps your business engine running month after month, or year after year.

So while MRR and ARR are crucial for understanding the health and growth of your business, it’s equally essential to keep a close eye on your costs and profitability. After all, the real fun begins when your recurring revenue comfortably covers your costs, and you’re making a tidy profit!

When to Use MRR

MRR is more than just a number – it’s a critical ally, charting your growth, helping you peek into the future of your revenue, and decode the puzzle of customer churn rates.

Understanding MRR is a straightforward process with substantial benefits. You start by taking the total recurring income generated in a given month and dividing it by the number of customers. What you’re left with is an average monthly revenue per customer.

This figure is a reliable benchmark, facilitating comparisons of performance over time or against your competitors. It’s like a financial health check-up for your business, offering insights that can steer you towards more informed decisions.

Before you jump on the MRR bandwagon, it’s important to take a beat. Ask yourself this: is your product or service dependent on a subscription-based pricing model, or is it more of a one-time purchase deal?

If your answer leans towards the former, MRR is going to be your new best friend, reliably predicting future monthly revenues from those recurring customer payments.

But hey, let’s not put MRR in a box. It’s not just for subscription-based businesses. If there’s a gap between customer acquisition and their first purchase, MRR can still play the role of the super sleuth, uncovering valuable insights.

By keeping tabs on MRR trends over time, you’ll gather an intel cache on the impact of your marketing campaigns, the responsiveness of customers to specific products or services, and the need for any strategic pivots.

While MRR is a powerful tool for tracking your business’s performance trajectory, it’s not a standalone success measure.

Editor’s Note: MRR is a key metric for measuring the success of tech startups, as it provides insight into customer churn rates and future revenue. Tracking changes in MRR over time can help keep businesses ahead of the game by fine-tuning their strategies to meet market demands.

When to Use MRR

While MRR can be a valuable tool for tracking the progress of a tech startup, it’s not always the most suitable metric for gauging success.

Here are a couple of examples…

When evaluating customer lifetime value (LTV), MRR falls short. It solely focuses on one-time purchases, excluding any additional products or services customers may acquire over time. This oversight means MRR doesn’t provide a comprehensive measure of LTV. For a fuller picture, metrics like CAC (customer acquisition cost), AOV (average order value), and ROI (return on investment) should be in the mix.

And when it comes to analyzing the impact of marketing campaigns, MRR doesn’t hit the mark either. Its focus on recurring revenue means it doesn’t consider any new leads or conversions borne from a campaign.

To accurately assess the effectiveness of your marketing, metrics like cost per lead and conversion rate deserve a starring role, sidelining MRR.

For startups offering different pricing tiers and service levels, annual recurring revenue (ARR) could be a better fit than MRR.

ARR includes all contracts, irrespective of their duration, giving you a comprehensive overview of your revenue, while still offering insights into monthly earnings from existing contracts.

So while MRR can serve as a useful yardstick to measure your tech startup’s performance and growth, it’s not universally applicable. Knowing when to swap MRR for more relevant metrics ensures a data-driven approach, boosting your startup’s growth prospects.

Editor’s Note: Though MRR is often a useful metric for tracking tech startups’ progress, other metrics such as CAC, AOV, and ROI may be more suitable in certain circumstances, while ARR could provide greater insight when there are multiple pricing tiers. For evaluating customer lifetime value and marketing campaigns, metrics like CAC, AOV, and ROI should be used instead. In addition, if your startup offers multiple pricing tiers with varying levels of services then ARR might be more beneficial than MRR as it takes into account all contracts regardless of duration.

When to Use ARR

When you’re plotting your tech startup’s course, ARR should be a part of your navigational tools.

Offering a snapshot of your company’s financial well-being and growth trajectory, ARR is invaluable to investors determining the worthiness of their investment and to founders seeking to optimize operations.

^^ This won’t be you after reading this blog!

Take, for example, entrepreneur Kam Lee.

Kam employed the principles of ARR to impressive effect in his business. Through the savvy application of techniques learned inside my Data Creatives & Co. Course, Kam closed 15 B2B contracts valued at $310,000. In addition, he pre-sold $60,000 worth of annual contracts for his forthcoming marketing optimization SaaS company.

For Kam, ARR was an essential tool in the kit that guided his decisions and ultimately drove substantial profit.

Primarily, ARR is your go-to when examining long-term revenue trends. It encompasses all recurring annual payments made by customers, like subscription fees or membership dues.

For tracking customer commitment and retention, nothing beats ARR. These metrics hinge on the number of customers renewing their annual contracts. Plus, ARR can help pinpoint areas ripe for enhancement or growth within your business model.

Projecting future cash flow or planning your budget? Let ARR take the wheel. This metric enables startups to foresee more accurately than methods considering only current income.

Furthermore, ARR can lend a hand in comparing your performance against industry competitors – especially those with similar pricing models. This comparison can provide valuable insights to help fine-tune your pricing strategies.

Using ARR requires a long-term vision, necessitating a balance between immediate benefits and future gains. Opting out of ARR demands a more meticulous analysis, considering various facets that should be thoughtfully evaluated.

Editor’s Note: ARR is the key to understanding a tech startup’s financial health and future growth potential, providing an accurate measure of customer loyalty and retention. ARR can be employed to allocate resources and contrast performance with industry peers, thus offering insight into pricing tactics in the future.

When to Avoid Using ARR

Although a favorite metric among tech startups for gauging success, ARR isn’t a one-size-fits-all solution. It has its limitations and certain situations demand alternative metrics.

Firstly, ARR doesn’t reflect short-term revenue growth with precision. Because it aggregates revenue over an annual period, it can overlook non-recurring income acquired within that timeframe.

If your startup has seen sporadic sales or one-time deals during the year, they might fly under the radar in ARR calculations, potentially skewing your results.

Another scenario where ARR might falter is in measuring customer churn rates. Instead of leaning on ARR to measure customer attrition, I’d suggest using customer lifetime value (LTV) instead.

LTV takes into account the duration of a customer’s engagement and their average spend per visit or monthly payment, offering a more nuanced understanding of why customers leave and how long they stick around before doing so.

Recognizing when to give ARR a miss is vital to avoid skewed performance assessments. In such cases, MRR might be a more suitable candidate for measuring your startup’s success.

Editor’s Note: ARR isn’t ideal for gauging quick income expansion or client attrition, since it disregards one-time payments and does not provide enough info about why clients are departing. Therefore, LTV is a more suitable option to get an accurate picture of your business performance.

MRR vs ARR: How to Calculate Them

Navigating the road to success in the tech startup landscape requires a firm grip on your metrics.

Now, with a solid grasp of MRR and ARR, it’s time to turn our attention toward accurately calculating these numbers.

Next, we’ll dissect the steps to precisely measure both MRR and ARR. And to ensure you’ve got all the practical know-how, here’s a short video from Eric Andrews, demonstrating these calculations in action…

Here’s a more detailed step-by-step of the process…

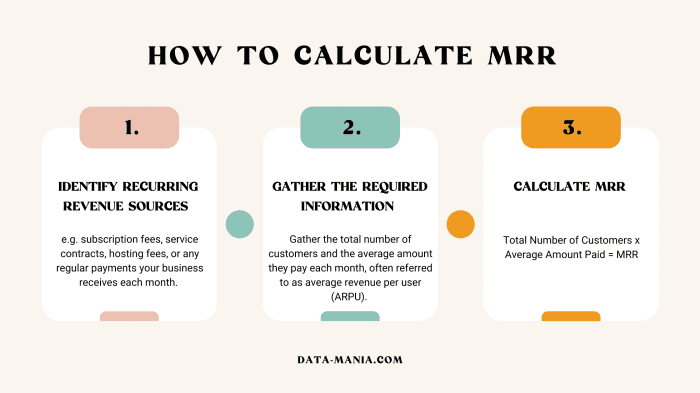

How to Calculate MRR

MRR provides a snapshot of your business’s growth and can help gauge the effectiveness of your strategies.

Here’s how to calculate it…

Step 1: Identify Recurring Revenue Sources

To calculate MRR, begin by identifying all recurring revenue sources.

These could be monthly subscription fees, service contracts, hosting fees, or any regular payments your business receives each month.

Step 2: Gather the Required Information

Next, you’ll need two key pieces of information: the total number of customers and the average amount they pay each month, often referred to as average revenue per user (ARPU).

This data can typically be sourced from your billing system, CRM software, or even customer surveys.

Step 3: Calculate MRR

Once you have the total number of customers and ARPU, you can calculate MRR using the following formula:

Total Number of Customers x Average Amount Paid = MRR

This gives you a rough estimate of the monthly revenue your company generates exclusively from recurring sources.

If there are additional one-time payments made during the month, add them separately after the MRR calculation to ensure you account for all income your business generates.

Now, let’s delve into calculating ARR for a more comprehensive view of your business growth…

Editor’s Note: Multiply the count of patrons utilizing your services by their usual expenditure each month to work out a firm’s MRR (Monthly Recurring Revenue). This will give you an accurate representation of how much money is being generated from recurring sources on a monthly basis, and any additional one-time payments should be added separately afterwards.

How to Calculate ARR

Annual recurring revenue (ARR) offers a glimpse of your tech startup’s anticipated yearly income, proving helpful to both founders and investors.

Here’s how to calculate it…

Step 1: Total Up MRR

To calculate ARR, begin by adding up all your monthly recurring revenue (MRR). This includes regular charges like subscription fees and usage-based fees.

Scroll up to the previous section for a more detailed view on calculating MRR.

Step 2: Convert MRR to ARR

Next, multiply your total MRR by 12.

This gives you the annualized version of your MRR, which is your ARR.

Step 3: Include One-Time Payments

For a more precise understanding of your yearly income, include any one-time payments like setup fees or other non-recurring charges made at least once per year in your ARR.

So, the calculation would look something like this:

(Total MRR x 12) + One-Time Payments = ARR

Understanding and calculating ARR equips founders to comprehend their business more profoundly and to plan more effectively for future revenue.

Moreover, monitoring ARR changes can highlight shifts in customer churn rates and flag potential product or service issues before they escalate

Common Pitfalls When Calculating MRR and ARR

Navigating through the world of metrics isn’t always straightforward. ARR and MRR are incredibly powerful tools for understanding the health and potential of your startup, but they’re also easy to misinterpret.

Here are some of the most common pitfalls that startups often stumble upon while calculating MRR and ARR:

- Misclassifying revenue: Some startups mix in one-time payments (like set-up fees or non-recurring add-ons) with their recurring revenue. MRR and ARR should only include recurring revenue that’s predictable and reliable.

- Ignoring churn: Failing to account for churn can paint an overly optimistic picture of your MRR and ARR. Remember to deduct churned revenue from your calculations.

- Counting future upgrades: Some startups count upgrades or upsells that haven’t happened yet. This can inflate MRR and ARR figures. Only include revenue from upgrades or upsells once they’ve been realized.

- Overlooking discounts: If you offer discounted annual plans, be sure to adjust your ARR accordingly. The same goes for any other price reductions or concessions.

- Ignoring sales cycle: Startups often overlook the sales cycle duration, especially those with longer cycles. When a deal is closed, the revenue should be spread across the duration of the contract for ARR.

- Misclassifying revenue: Some startups mix in one-time payments (like set-up fees or non-recurring add-ons) with their recurring revenue. MRR and ARR should only include recurring revenue that’s predictable and reliable.

Avoiding these common mistakes can help ensure that your MRR and ARR calculations provide an accurate and useful perspective on your startup’s financial health.

Achieving Business Health: The Rule of 40 and ARR

When you’re steering a tech startup, you’re likely going to encounter the Rule of 40. Now, this rule isn’t just a bit of industry jargon, it’s a compass guiding the balance between growth and profitability.

You might be wondering how this relates to annual recurring revenue (ARR). Well, let’s dive into that…

The Rule of 40 states that a healthy tech startup’s growth rate and profit margin should total 40% or more.

But what’s the measuring stick for this growth rate? You guessed it, it’s your ARR.

Your ARR growth rate is an indicator of your startup’s momentum, and when combined with your profit margin, it’s a powerhouse of insights about your company’s health. If these two add up to 40% or more, you’re sailing smoothly.

So why does this matter?

Well, the Rule of 40 and ARR go hand-in-hand. ARR is all about predicting future revenue based on current customer subscriptions. It’s like the heartbeat of your business’s growth. The Rule of 40, then, gives context to this heartbeat, placing it in the larger picture of overall business health, which includes profitability.

Remember, while ARR and the Rule of 40 are closely intertwined, they aren’t the be-all-end-all of your business metrics. They’re important, yes, but they’re part of a broader dashboard of metrics you should monitor.

It’s all about finding the right balance and charting the course that’s right for your tech startup. So, use ARR and the Rule of 40 as part of your navigational tools, but don’t lose sight of the broader horizon.

FAQs in Relation to MRR vs ARR

What is the main difference between ARR and MRR?

ARR (annual recurring revenue) and MRR (monthly recurring revenue) are both key metrics used by businesses with subscription models to measure the total predictable and recurring revenue.

The main difference between them is the time period they consider:

- A startup’s MRR is its predictable income every month. It’s calculated by multiplying the number of customers by the average billed amount during a month.

For example, if a business has 100 customers, each paying $10 per month, the MRR would be 100 (customers) x $10 (average monthly payment) = $1000.

- In contrast, ARR measures the recurring revenue from your term subscriptions normalized to a one-year period. It’s calculated by taking the MRR and multiplying it by 12. Simple.

According to the above example, if the MRR is $1000, the ARR would be $1000 (MRR) x 12 (months in a year) = $12,000.

MRR vs ARR: which one should I use?

MRR suits startups with monthly subscriptions or quick sales cycles, helping you spot changes and adjust your tactics pronto.

ARR is your go-to for annual subscriptions or longer sales cycles. It’s your compass for strategic planning and perfect for wowing investors with the bigger picture of your financial growth.

But hey, why choose?

MRR and ARR are two sides of the same coin. Use MRR to stay nimble and make swift moves, and ARR to steer your long-term strategy. With both in your arsenal, you’re in control of your business’s financial story.

Why are ARR and MRR so important to the cloud business?

ARR and MRR are like the bread and butter for gauging your startup’s endurance.

Think of ARR as your year-long financial barometer, measuring the money you’re pocketing from recurring sources across 12 months. Then there’s MRR, its monthly counterpart. These two metrics are your trusty GPS, honing in on the viability and growth trajectory of your cloud operations.

They’re your private detectives, sniffing out invaluable intel on customer retention, customer lifetime value, cash flow forecasting, and the nitty-gritty of your financial health.

And it doesn’t stop there. Keeping tabs on ARR and MRR means getting an up-close and personal look at your customer base. Imagine having clear-cut visibility into how different customer segments engage with your services or how usage trends shift over time.

What is a good ARR growth rate?

According to Metric HQ, a good ARR for SaaS businesses depends on how much revenue you’re generating…

- If you’re generating an ARR between 1-5M, a good median year-on-year (YoY) ARR Growth Rate to aim for falls between 52% and 59%. But if you want to be in the top echelon, you should be looking at rates between 102% and 154%.

- For those with an ARR in the range of 5-15M, the goalposts shift slightly. Here, the median YoY ARR Growth Rate lies between 46% and 55%. The top quarter of businesses in this bracket are boasting growth rates between 100% and 131%.

- If you’re generating an ARR between 1-5M, a good median year-on-year (YoY) ARR Growth Rate to aim for falls between 52% and 59%. But if you want to be in the top echelon, you should be looking at rates between 102% and 154%.

But remember, these are just industry averages and high benchmarks. Your company’s specific situation, the competitive landscape, and your strategic goals can all impact what a good ARR Growth Rate looks like for your business. As always, strive for growth, but stay rooted in your unique reality.

What is a good MRR growth rate?

Industry insiders peg the sweet spot at around 10-20%. If you’re consistently hitting those figures, you’re certainly on a promising trajectory.

But don’t stop there – curbing customer churn can provide a major boost to your MRR growth. Meanwhile, seizing opportunities for upselling, cross-selling, and add-ons can take you further toward your optimal MRR growth rate.

Just keep in mind, these are broad benchmarks. Your specific business context, including your model, customer behavior, and market conditions, can influence what your ideal MRR growth rate should be. Keep striving for better, but stay rooted in your unique business reality.

How does customer churn affect MMR and ARR?

Churn is the percentage of your customers that cut ties with your service during a certain time frame. A high churn rate is the arch-nemesis of your MRR and ARR. It’s like a leak in your revenue bucket, and if you’re not careful, it can drain your MRR or ARR fast.

So here’s the deal – a lower churn rate equals healthier MRR and ARR. You retain more customers, meaning you keep the recurring revenue flowing in, boosting these metrics. On the flip side, a rising churn rate could be a red flag, a potential indicator that something in your business might need tweaking.

Remember, it’s not just about bringing new customers on board, but also about keeping the ones you already have. This balance is key to maintaining and growing your MRR and ARR.

What is the difference between contracted annual recurring revenue and annual recurring revenue?

Contracted ARR, that’s the money you’re certain about, the sure thing. You’ve got contracts, promises, and commitments.

Imagine stacking up all your customer contracts and multiplying them by their contract lengths – that’s your contracted ARR.

Now, ARR, that’s your real-time financial snapshot. It’s what your company’s actually pocketing from clients during a specific period. It’s the combo of your contracted ARR and any new business you’ve managed to reel in.

So, the crux of the matter? One is focusing on what’s promised, while the other is your reality check, based on performance. Just like your bank balance and your paycheck, they’re two sides of the same coin.

Can annual recurring revenue be higher than revenue?

No, annual recurring revenue (ARR) cannot be higher than revenue. ARR is a metric that measures the total value of contracted recurring revenue from customers over a 12-month period and does not include one-time sales or nonrecurring income.

ARR will remain constant, regardless of any short-term fluctuations in income from month to month; it is a cumulative figure based on recurrent payments over the course of one year. Therefore, ARR can never exceed overall revenue because all other sources are included in the latter but not necessarily accounted for in the former.

What other metrics should I consider in addition to MRR and ARR?

Other important metrics include customer acquisition cost (CAC), average revenue per user (ARPU), customer lifetime value (LTV), and churn rate. These can help you understand the cost-effectiveness of your marketing efforts, the profitability of each customer, and customer retention, respectively.

Final Thoughts

MRR and ARR aren’t just fancy tech startup jargon; they’re the key to cracking your growth strategy. Got ’em in your toolkit? Good. You’re armed and ready to measure the impact of your business strategies.

But remember, these metrics aren’t a one-size-fits-all solution. You need to be savvy about when and where to use MRR vs ARR, depending on your current needs.

Eager to unlock your startup’s potential? Join my newsletter on substack to get more valuable free training.

↓↓↓